Florida Law Motorcycle Insurance

Introduction

Dear Readers,

Image Source: thejasponfirm.com

Welcome to our article on Florida Law Motorcycle Insurance. In this article, we will provide you with comprehensive information about motorcycle insurance laws in Florida. Whether you are a motorcycle enthusiast or a resident of Florida, understanding the laws and regulations surrounding motorcycle insurance is crucial for your safety and legal compliance. We hope this article will serve as a valuable resource for you.

Now, let’s delve into the details of Florida Law Motorcycle Insurance and explore everything you need to know.

What is Florida Law Motorcycle Insurance?

Image Source: cloudinary.com

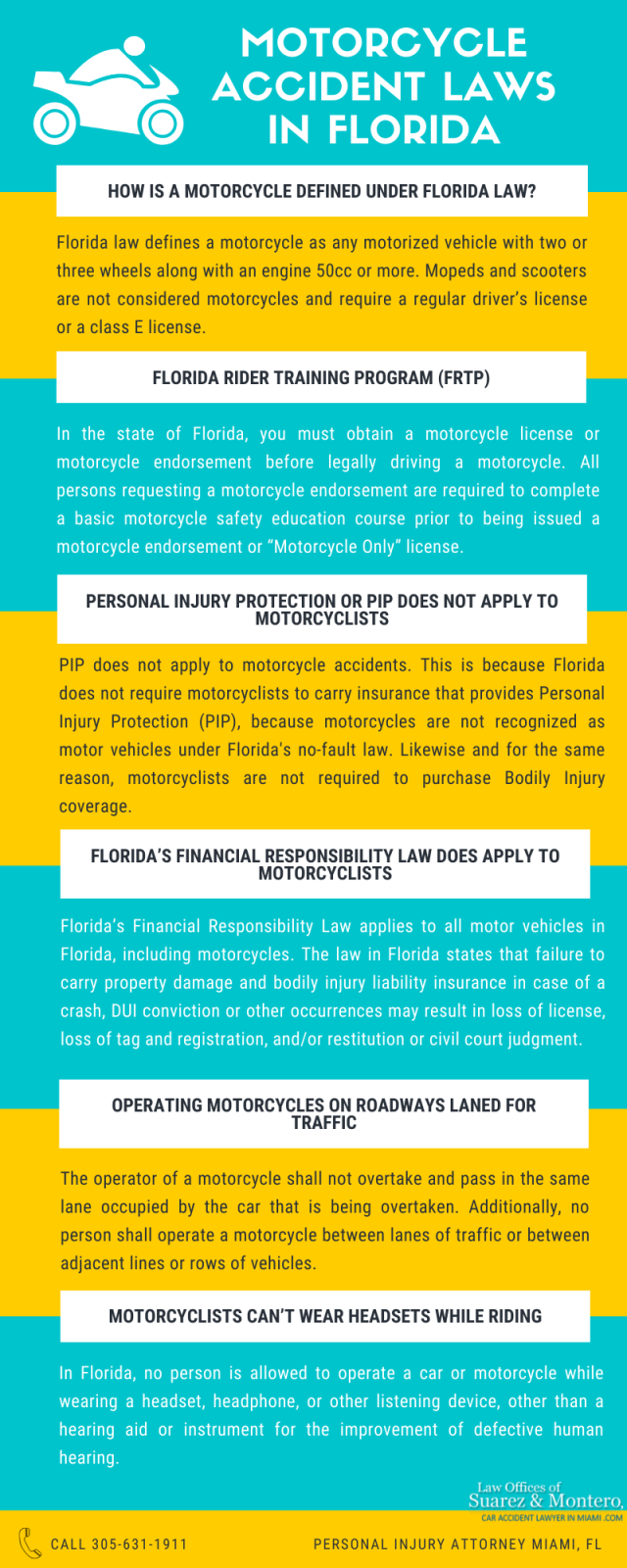

📌 Florida Law Motorcycle Insurance refers to the mandatory insurance coverage required for motorcycle owners in the state of Florida. As per the law, all motorcycle owners must carry a minimum level of insurance to protect themselves and others in the event of an accident.

Image Source: jaime-suarez.com

📌 The purpose of this insurance is to ensure that injured parties receive compensation for their medical expenses and property damage, as well as to provide liability coverage for motorcycle owners.

📌 The insurance coverage required under Florida law includes both Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage.

📌 PIP coverage helps pay for your medical expenses if you are injured in a motorcycle accident, while PDL coverage helps cover the cost of repairing or replacing someone else’s property damaged in an accident you caused.

📌 It is important to note that Florida is a no-fault state, which means that each party involved in an accident is responsible for their own expenses, regardless of who was at fault.

📌 However, Florida law requires motorcycle owners to carry insurance coverage to ensure that injured parties are compensated for their losses.

Who is Required to Have Motorcycle Insurance in Florida?

📌 All motorcycle owners in Florida are required by law to carry insurance coverage for their motorcycles.

📌 This includes owners of all types of motorcycles, such as street motorcycles, cruisers, sport bikes, and choppers.

📌 Whether you own a brand new motorcycle or an older model, insurance coverage is mandatory.

📌 The law applies to both resident and non-resident motorcycle owners, as long as the motorcycle is operated within the state of Florida.

📌 It is important to note that if you fail to carry the required insurance coverage, you may face legal consequences, including fines and license suspension.

📌 Therefore, it is essential for all motorcycle owners in Florida to comply with the insurance requirements set by the law.

When Should You Obtain Motorcycle Insurance in Florida?

📌 According to Florida law, motorcycle owners must obtain insurance coverage before they can legally operate their motorcycles on public roads.

📌 This means that if you plan to ride your motorcycle in Florida, you must have insurance coverage in place before hitting the road.

📌 Whether you are a new motorcycle owner or moving to Florida with an existing motorcycle, it is important to obtain insurance as soon as possible to comply with the law.

📌 Additionally, if you are renewing your motorcycle registration, you will need to provide proof of insurance to the Department of Highway Safety and Motor Vehicles (DHSMV).

📌 It is a good practice to obtain insurance coverage well in advance to avoid any last-minute complications or delays.

Where Can You Obtain Motorcycle Insurance in Florida?

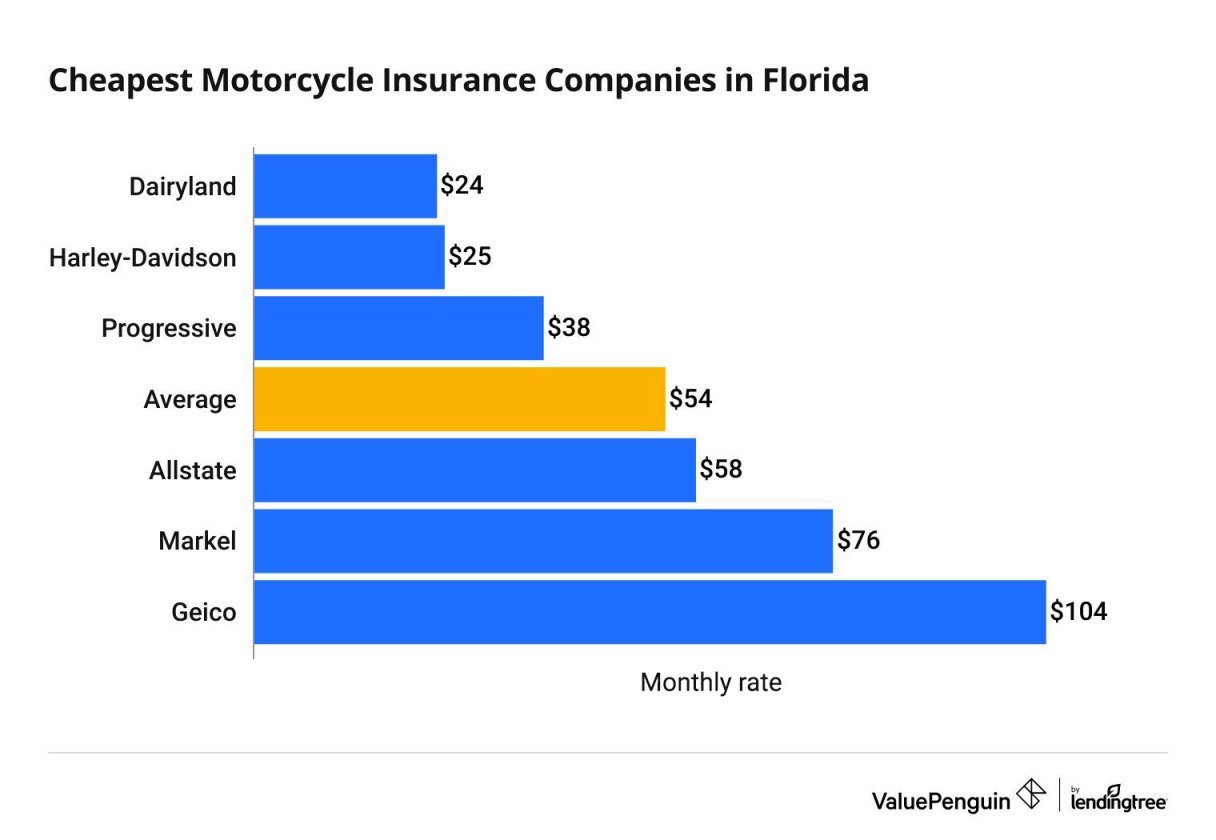

📌 Motorcycle insurance can be obtained from various insurance companies that provide coverage in the state of Florida.

📌 You can start by researching different insurance providers and comparing their coverage options and rates.

📌 It is recommended to obtain quotes from multiple providers to ensure you get the best coverage at the most affordable price.

📌 The insurance coverage you choose should meet the minimum requirements set by Florida law, including the required levels of PIP and PDL coverage.

📌 Additionally, you may also consider optional coverage options, such as comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage, depending on your individual needs.

📌 Once you have chosen an insurance provider and obtained the required coverage, make sure to keep your insurance information readily available and up to date.

Why is Motorcycle Insurance Required in Florida?

📌 Motorcycle insurance is required in Florida to ensure that injured parties receive compensation for their losses in the event of an accident.

📌 By carrying insurance coverage, motorcycle owners fulfill their financial responsibility to others on the road.

📌 Motorcycle accidents can result in significant medical expenses, property damage, and other losses.

📌 Having insurance coverage helps protect motorcycle owners from potential lawsuits and provides the necessary funds to cover the costs associated with accidents.

📌 Additionally, insurance coverage offers financial protection to motorcycle owners by covering their own medical expenses in case of an accident.

📌 Overall, requiring motorcycle insurance in Florida helps promote safety and financial stability for all parties involved in accidents.

How Can You Obtain the Best Motorcycle Insurance Coverage in Florida?

📌 To obtain the best motorcycle insurance coverage in Florida, it is important to carefully consider your individual needs and priorities.

📌 Start by researching different insurance providers and comparing their coverage options, rates, and customer reviews.

📌 Identify the coverage limits and options that best suit your situation.

📌 Additionally, consider factors such as your motorcycle’s value, your riding habits, and your budget.

📌 It is also recommended to consult with insurance agents or brokers who specialize in motorcycle insurance to help guide you through the process.

📌 Finally, make sure to review your insurance policy regularly and update it as needed to ensure you have adequate coverage at all times.

Advantages and Disadvantages of Florida Law Motorcycle Insurance

Advantages:

📌 Provides financial protection in case of accidents: Motorcycle insurance ensures that injured parties receive compensation for their losses, protecting motorcycle owners from potential lawsuits.

📌 Offers coverage for medical expenses: Insurance coverage helps cover the medical expenses of motorcycle owners in case of accidents, providing financial security during difficult times.

📌 Promotes safer riding habits: The requirement to have insurance coverage encourages motorcycle owners to ride responsibly and be aware of the potential risks and consequences of accidents.

Disadvantages:

📌 Adds to the cost of motorcycle ownership: Motorcycle insurance premiums can be a significant expense, adding to the overall cost of owning and maintaining a motorcycle.

📌 Limited coverage options: The mandatory insurance coverage under Florida law may not fully cover all potential damages and losses, leaving motorcycle owners responsible for additional costs.

Frequently Asked Questions (FAQ)

1. Is motorcycle insurance mandatory in Florida?

📌 Yes, motorcycle insurance is mandatory for all motorcycle owners in Florida.

2. What are the minimum insurance requirements for motorcycles in Florida?

📌 The minimum insurance requirements in Florida include Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage.

3. Can I get motorcycle insurance quotes online?

📌 Yes, most insurance providers offer online quotes for motorcycle insurance.

4. Can I choose to have additional coverage beyond the minimum requirements?

📌 Yes, you can choose to have additional coverage options, such as comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage.

5. What happens if I don’t have motorcycle insurance in Florida?

📌 If you fail to carry the required insurance coverage, you may face legal consequences, including fines and license suspension.

Conclusion

In conclusion, Florida Law Motorcycle Insurance is a crucial requirement for all motorcycle owners in the state. By carrying the mandatory insurance coverage, motorcycle owners ensure their financial responsibility to others on the road and protect themselves from potential lawsuits. Additionally, insurance coverage provides the necessary funds to cover medical expenses and property damage in case of accidents. It is essential for all motorcycle owners in Florida to comply with the insurance requirements and obtain the best coverage that suits their individual needs. Stay safe and enjoy the ride!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be taken as legal or insurance advice. For specific guidance regarding motorcycle insurance in Florida, please consult with a licensed insurance professional or legal advisor.

Comments

Post a Comment