Master Policy Insurance: A Comprehensive Guide

Greetings, Readers. In today’s article, we will delve into the world of Master Policy Insurance. This comprehensive guide will provide you with valuable insights into this insurance policy and its relevance in today’s world. So, let’s embark on this informative journey together!

Introduction

Insurance plays a crucial role in safeguarding individuals and businesses from unforeseen risks. One such insurance policy that provides comprehensive coverage is the Master Policy Insurance. It is a contract between an insurance company and a policyholder that offers protection against various potential risks. This type of insurance is commonly utilized by businesses to protect their assets and operations.

Master Policy Insurance provides coverage for a range of risks, including property damage, liability claims, and even employee injuries. By obtaining this policy, businesses can mitigate the financial burden and potential losses that may arise from unfortunate events. It serves as a valuable safety net in an unpredictable business landscape.

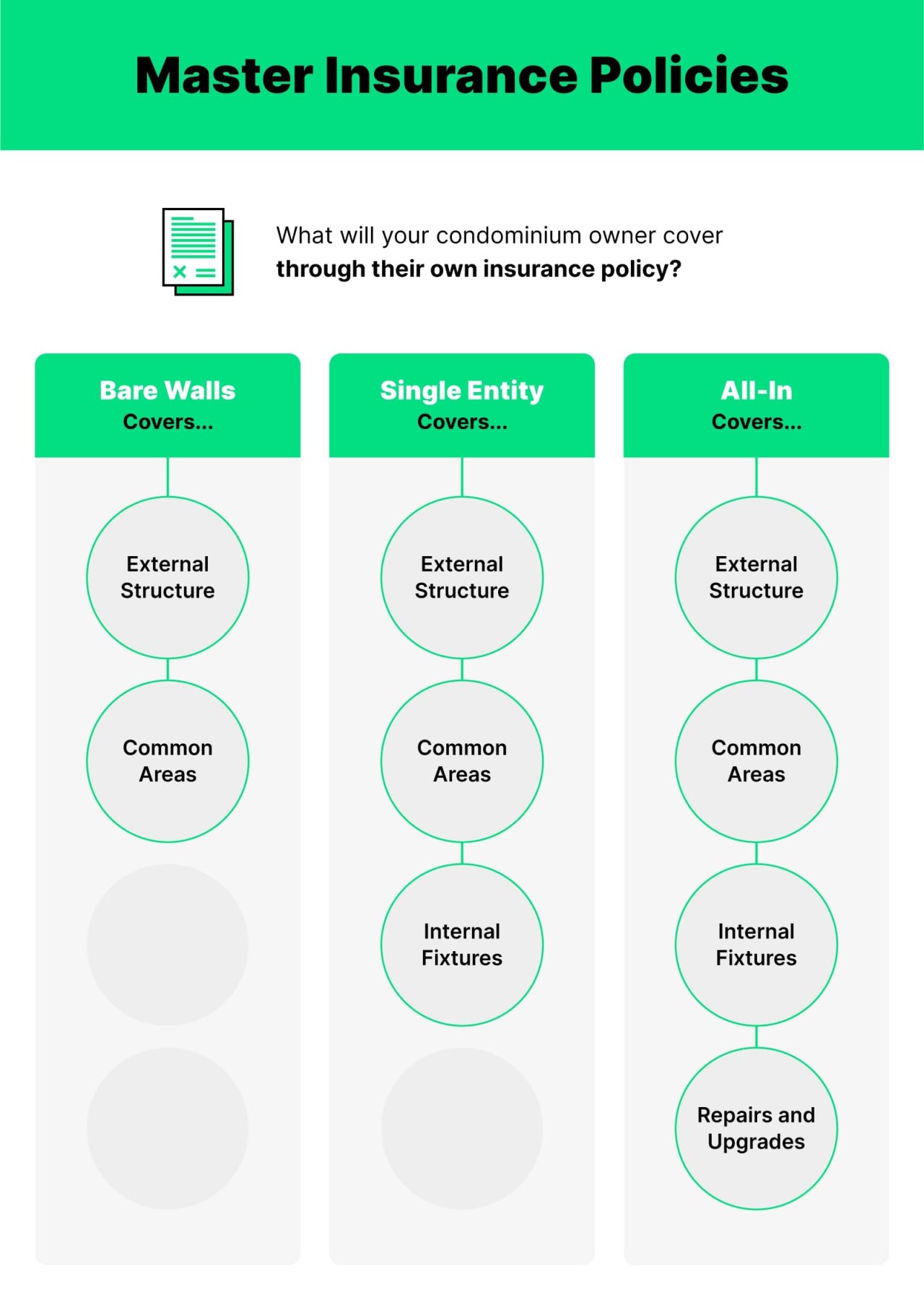

Image Source: hippo.com

Now, let us explore the key aspects of the Master Policy Insurance in more detail.

What is Master Policy Insurance? 📚

Master Policy Insurance is a comprehensive insurance policy that offers coverage for various risks faced by businesses. It is a contract between the insurance company, referred to as the insurer, and the policyholder, also known as the insured. The policyholder pays a premium to the insurer in exchange for the coverage provided.

This type of insurance is often obtained by businesses that have multiple assets or operations to protect. It consolidates multiple policies into a single, manageable policy, making it easier for businesses to handle their insurance needs. It can cover a wide range of risks, including property damage, liability claims, and even employee injuries.

Master Policy Insurance is designed to provide businesses with comprehensive coverage for potential risks, helping them navigate uncertainties and protect their financial interests.

Who Can Benefit from Master Policy Insurance? 🤔

Master Policy Insurance is particularly beneficial for businesses of all sizes and industries. It provides comprehensive coverage that can be tailored to fit the specific needs of each business. Small businesses, in particular, can benefit from this type of insurance as it offers a cost-effective solution to protect their assets and operations.

Additionally, businesses that operate in high-risk industries or have multiple locations can greatly benefit from Master Policy Insurance. It allows them to streamline their insurance coverage and manage their risks effectively.

It is important to note that Master Policy Insurance is not limited to businesses alone. Landlords, property managers, and homeowners’ associations can also benefit from this type of insurance to protect their properties and reduce potential liabilities.

When Should You Consider Master Policy Insurance? â°

Considering Master Policy Insurance should be a priority for businesses that want to protect their financial interests and mitigate potential losses. It is particularly important for businesses that:

Own multiple properties or have various business locations.

Operate in high-risk industries, such as construction or manufacturing.

Want to consolidate their insurance policies for ease of management.

Desire comprehensive coverage for a range of potential risks.

If your business falls into any of these categories, it is essential to explore the benefits and coverage offered by Master Policy Insurance.

Where Can You Obtain Master Policy Insurance? ðŸŒ

Master Policy Insurance can be obtained from various insurance companies and brokers. It is advisable to seek professional advice from insurance experts who can assess your business’s specific needs and recommend the most suitable coverage options.

Researching and comparing different insurers and their policies is crucial to ensure you obtain the best coverage at competitive rates. Additionally, consulting with industry peers and associations can provide valuable insights and recommendations.

Why Choose Master Policy Insurance? 🤷â€â™‚ï¸

There are several compelling reasons to choose Master Policy Insurance for your business:

1. Comprehensive Coverage

Master Policy Insurance offers comprehensive coverage for a wide range of risks, providing businesses with financial protection in the face of potential losses.

2. Cost-Effective

Consolidating multiple policies into a single master policy can often result in cost savings for businesses. It eliminates the need to manage and pay premiums for individual policies separately.

3. Simplified Management

With a Master Policy Insurance in place, businesses can streamline their insurance coverage, simplifying the management and administration of policies.

4. Tailored Coverage

Master Policy Insurance can be customized to suit the specific needs of each business, ensuring they have the appropriate coverage for their assets and operations.

5. Peace of Mind

By obtaining Master Policy Insurance, businesses can enjoy peace of mind, knowing that they are protected against potential risks and liabilities.

Advantages and Disadvantages of Master Policy Insurance 📊

Advantages:

1. Comprehensive Protection

Master Policy Insurance offers businesses comprehensive protection against a variety of risks, reducing the potential financial impact of unexpected events.

2. Cost Savings

Consolidating multiple policies into one master policy often leads to cost savings for businesses, making it a cost-effective option.

3. Simplified Management

Managing a single master policy is more convenient and less time-consuming compared to handling multiple individual policies.

4. Tailored Coverage

Master Policy Insurance allows businesses to customize their coverage to fit their specific needs, ensuring they have the right level of protection.

5. Risk Mitigation

By having comprehensive coverage, businesses can reduce their exposure to potential risks and minimize the financial impact of unforeseen events.

Disadvantages:

1. Higher Premiums

While Master Policy Insurance provides comprehensive coverage, it may come with higher premiums compared to individual policies.

2. Limited Flexibility

Once a master policy is in place, making changes or adding new coverage options may be more complex and less flexible.

3. Potential Coverage Gaps

Depending on the policy’s terms and conditions, there may be coverage gaps that businesses need to be aware of and address with additional policies if necessary.

4. Policy Complexity

Master Policy Insurance can be complex, especially for businesses operating in multiple locations or industries. It requires careful evaluation and understanding of the policy’s terms and conditions.

5. Limited Availability

Not all insurers offer Master Policy Insurance. Businesses may need to conduct thorough research to find insurers that provide this type of coverage.

Frequently Asked Questions (FAQs) â“

1. Is Master Policy Insurance only for businesses?

No, Master Policy Insurance can also be obtained by landlords, property managers, and homeowners’ associations to protect their properties and reduce liabilities.

2. Can I customize the coverage of my Master Policy Insurance?

Yes, Master Policy Insurance can be tailored to fit the specific needs of your business or property, ensuring you have the appropriate coverage.

3. How can I find the right insurer for Master Policy Insurance?

Researching and comparing different insurers’ offerings is crucial. Consulting with insurance experts and seeking recommendations can also help you find the right insurer.

4. Can Master Policy Insurance cover employee injuries?

Yes, depending on the policy, Master Policy Insurance can provide coverage for employee injuries and related liabilities.

5. Is Master Policy Insurance more expensive than individual policies?

While the premiums for Master Policy Insurance may be higher, consolidating multiple policies into one can often result in cost savings for businesses.

Conclusion: Take Action Today! 🚀

Master Policy Insurance offers businesses and property owners a comprehensive solution to protect their assets and operations from potential risks. By consolidating multiple policies into one, businesses can simplify their insurance management and ensure they have the appropriate coverage.

Take action today and explore the possibilities of Master Policy Insurance for your business or property. Consult with insurance experts, compare offerings from different insurers, and find the coverage that best suits your needs.

Remember, the unpredictable nature of business and life necessitates the need for comprehensive insurance coverage. Protect your financial interests and secure your future with the right insurance policy.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional advice. It is always recommended to consult with insurance experts and professionals to determine the most appropriate insurance coverage for your specific needs.

Comments

Post a Comment