Unlock Your Potential: Mastering The Path To Becoming A Successful Independent Insurance Claims Adjuster

How To Become An Independent Insurance Claims Adjuster

Greetings, Readers! In this article, we will explore the process and requirements of becoming an independent insurance claims adjuster. If you have an interest in the insurance industry and are looking for a rewarding career path, becoming an independent insurance claims adjuster might be the perfect fit for you. This article will provide you with a comprehensive guide on how to pursue this profession.

Introduction

Insurance claims adjusters play a crucial role in the insurance industry. They are responsible for evaluating and determining the validity and value of insurance claims made by policyholders. Independent insurance claims adjusters work on a freelance basis, representing insurance companies or policyholders, rather than being employed directly by a single company. This allows them to have more flexibility in their work and potentially earn a higher income.

Image Source: bannerbear.com

What is an independent insurance claims adjuster?

An independent insurance claims adjuster is a professional who assesses insurance claims on behalf of insurance companies or policyholders. They investigate the circumstances of a claim, examine evidence, interview involved parties, and determine the appropriate amount of compensation to be awarded.

Image Source: media-amazon.com

Who can become an independent insurance claims adjuster?

Becoming an independent insurance claims adjuster requires a certain set of skills and qualifications. While there are no strict educational requirements, most states require adjusters to be licensed. Additionally, having a background in fields such as finance, law, or construction can be beneficial in this profession.

When should you consider becoming an independent insurance claims adjuster?

If you are a detail-oriented individual who enjoys problem-solving and has excellent communication skills, becoming an independent insurance claims adjuster could be a great career choice. This profession offers opportunities for growth and advancement, as well as the ability to work independently and have a flexible schedule.

Where can you work as an independent insurance claims adjuster?

Independent insurance claims adjusters can work in various settings. They may be employed by insurance companies, work as independent contractors, or even set up their own adjusting firms. The demand for adjusters is typically high in areas prone to natural disasters or regions with a high concentration of insurance companies.

Why should you become an independent insurance claims adjuster?

There are several benefits to pursuing a career as an independent insurance claims adjuster. Firstly, the earning potential can be significant, especially for experienced adjusters. Additionally, working as an independent contractor allows for more flexibility in terms of work hours and location. Moreover, this profession provides the opportunity to help individuals and businesses recover from unexpected losses.

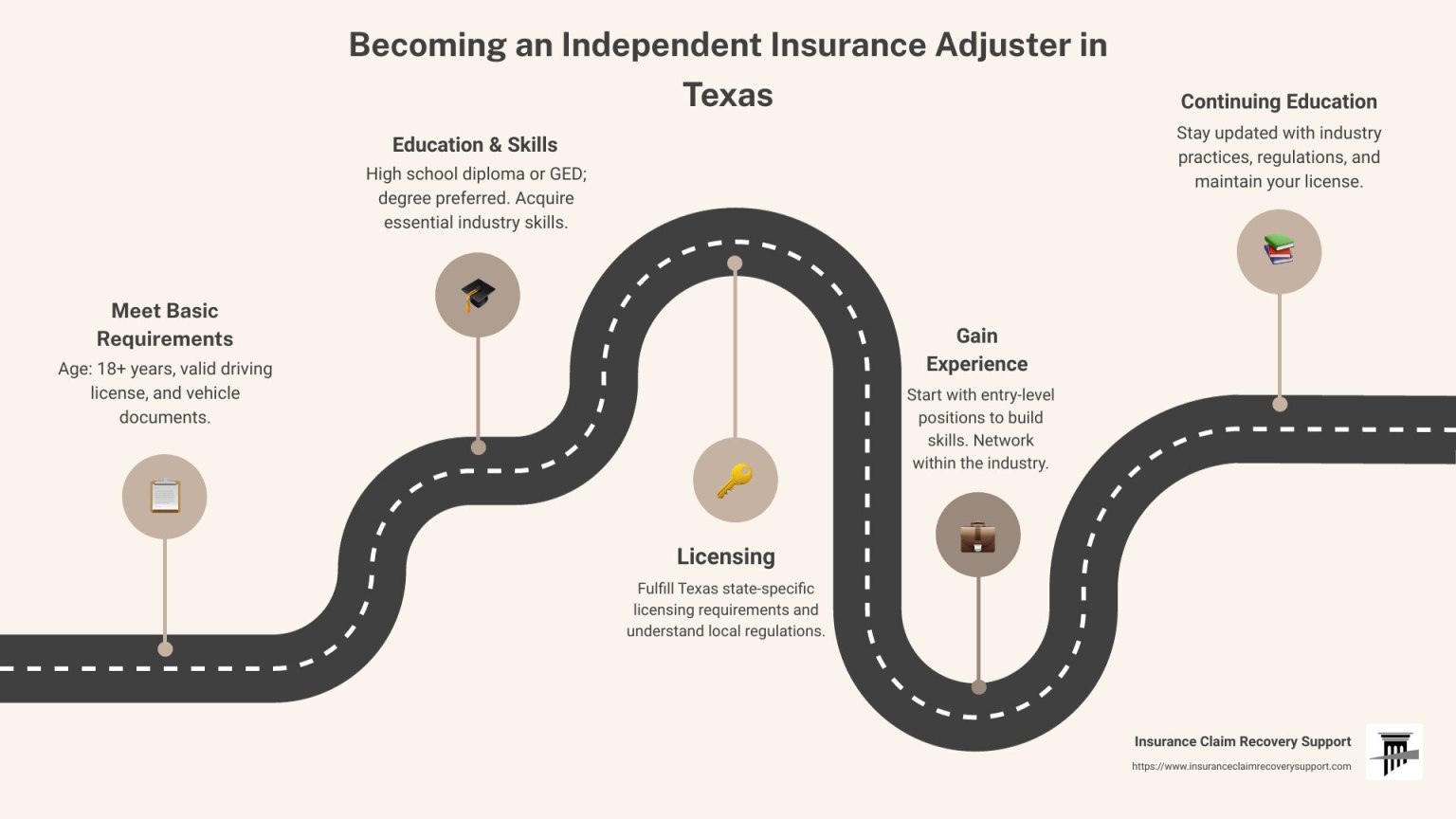

How can you become an independent insurance claims adjuster?

To become an independent insurance claims adjuster, you will need to follow a few key steps. These typically include obtaining the necessary licensing, gaining practical experience, and building a network within the industry. It’s also important to continuously update your skills and knowledge through professional development courses and certifications.

Advantages and Disadvantages of Becoming an Independent Insurance Claims Adjuster

Advantages

1ï¸âƒ£ Flexibility: As an independent insurance claims adjuster, you have the freedom to choose your work assignments and set your own schedule.

2ï¸âƒ£ Higher earning potential: Independent adjusters often earn a higher income compared to adjusters employed by insurance companies.

3ï¸âƒ£ Variety of work: Working as an independent adjuster allows you to handle a diverse range of insurance claims, providing opportunities for personal and professional growth.

4ï¸âƒ£ Independence: You have the autonomy to make decisions and negotiate settlements on behalf of your clients without strict oversight.

5ï¸âƒ£ Networking opportunities: Interacting with professionals in the insurance industry can lead to valuable connections and future opportunities.

Disadvantages

1ï¸âƒ£ Inconsistent workload: The demand for independent adjusters can fluctuate, leading to periods of high workload followed by slower periods.

2ï¸âƒ£ Uncertain income: Independent adjusters may experience variations in their income due to the unpredictable nature of the insurance industry.

3ï¸âƒ£ Administrative tasks: As an independent adjuster, you are responsible for managing your own business operations, including paperwork, marketing, and accounting.

4ï¸âƒ£ Limited benefits: Unlike employees of insurance companies, independent adjusters typically do not receive benefits such as healthcare or retirement plans.

5ï¸âƒ£ Liability risks: Independent adjusters may face potential liability for errors or omissions in their work, requiring them to carry professional liability insurance.

Frequently Asked Questions (FAQ)

1. How long does it take to become an independent insurance claims adjuster?

The time it takes to become an independent insurance claims adjuster can vary. It typically involves obtaining the necessary licensing, which could range from a few weeks to several months, depending on your location and the specific requirements. Gaining experience and building a reputation may take additional time.

2. Do I need a college degree to become an independent insurance claims adjuster?

While a college degree is not always a requirement to become an independent insurance claims adjuster, having a degree can be beneficial. It demonstrates your knowledge and commitment to the field, which can enhance your chances of being hired by insurance companies or attract potential clients.

3. What skills are essential for a successful independent insurance claims adjuster?

Key skills for independent insurance claims adjusters include strong analytical and investigative abilities, excellent communication and negotiation skills, attention to detail, and the ability to work independently and under pressure. A solid understanding of insurance policies and regulations is also crucial.

4. Can I work as an independent insurance claims adjuster part-time?

Yes, working part-time as an independent insurance claims adjuster is possible. Many adjusters start their careers by working part-time while gaining experience and building a client base. However, keep in mind that this may impact the number of assignments and income potential.

5. How do I find clients as an independent insurance claims adjuster?

Building a network within the insurance industry is essential for finding clients as an independent insurance claims adjuster. Attend industry events, join professional organizations, and establish relationships with insurance companies, insurance agents, and other professionals in related fields. Marketing yourself through online platforms and creating a professional website can also help attract potential clients.

Conclusion

In conclusion, becoming an independent insurance claims adjuster can offer a rewarding and lucrative career opportunity for those with the right skills and qualifications. The flexibility, higher earning potential, and the ability to help individuals and businesses in times of need are just a few of the advantages this profession provides. By following the necessary steps and continuously improving your skills, you can establish yourself as a successful independent insurance claims adjuster.

Take the first step towards this exciting career path and embark on a journey that combines problem-solving, communication, and the opportunity to make a difference. Start your journey to becoming an independent insurance claims adjuster today!

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as legal or financial advice. Please consult with a licensed professional for specific guidance related to your individual situation.

Comments

Post a Comment