Baton Rouge Car Insurance

Greetings, Readers! Today, we will delve into the topic of Baton Rouge Car Insurance. In this article, we will provide you with all the essential information you need to know about car insurance in Baton Rouge. Whether you’re a new driver or a seasoned one, having the right car insurance coverage is crucial for your peace of mind on the road. So, let’s get started and explore the world of Baton Rouge Car Insurance.

Introduction

Car insurance is a legal requirement for drivers in Baton Rouge, Louisiana, and it provides financial protection in case of accidents, theft, or damage to your vehicle. It is designed to cover the costs associated with these unfortunate events, ensuring that you don’t have to bear the financial burden alone. In this section, we will outline the key aspects of Baton Rouge Car Insurance that every driver should be aware of.

1. What is Baton Rouge Car Insurance? 🚗

Image Source: lanoixagency.com

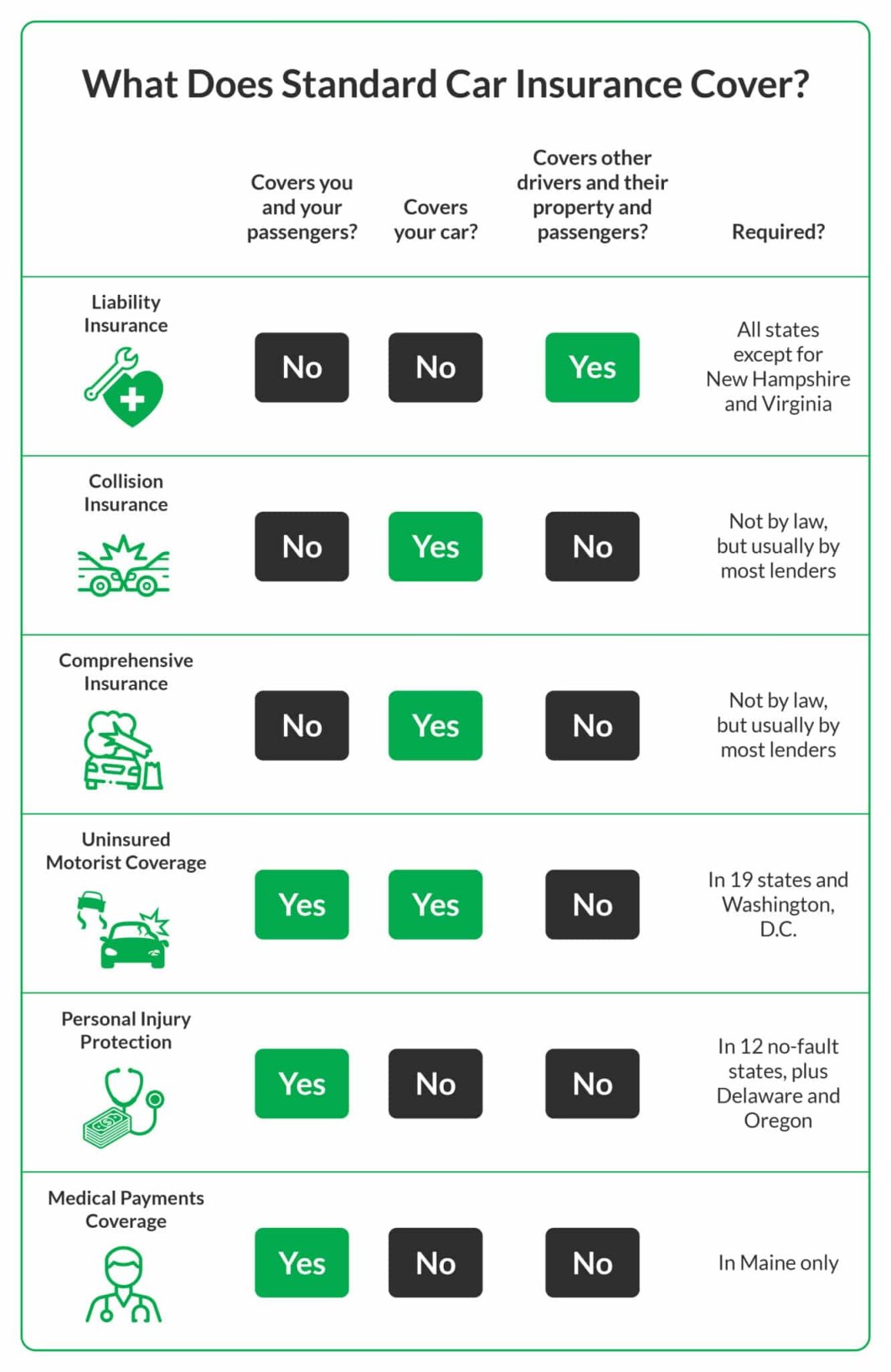

Baton Rouge Car Insurance refers to the insurance policies offered by various insurance providers to drivers in Baton Rouge. It typically includes coverage for bodily injury liability, property damage liability, medical payments, collision coverage, and comprehensive coverage. These coverages protect you, your passengers, and your vehicle in case of accidents or other covered events.

2. Who needs Baton Rouge Car Insurance? 🤔

Image Source: cloudfront.net

Every driver in Baton Rouge is required by law to have car insurance. Whether you own a car, rent one, or borrow one, you must have adequate car insurance coverage. Failure to have proper insurance can result in fines, license suspension, or even legal consequences. It is important to note that Louisiana follows a tort system, meaning that the at-fault driver is responsible for the damages they cause.

3. When should you get Baton Rouge Car Insurance? 📅

Image Source: cloudfront.net

You should obtain Baton Rouge Car Insurance as soon as you become a licensed driver or own a vehicle. It is crucial to have insurance coverage before getting behind the wheel. Even if you don’t own a car but frequently borrow or rent one, you should consider purchasing non-owner car insurance to protect yourself and others while driving.

4. Where can you get Baton Rouge Car Insurance? ðŸ“

There are numerous insurance companies and agents in Baton Rouge that offer car insurance policies. You can choose to purchase insurance directly from an insurer, through an agent, or even online. It is important to compare quotes, coverage options, and customer reviews to find the best insurance provider that suits your needs and budget.

5. Why is Baton Rouge Car Insurance important? â“

Baton Rouge Car Insurance is important for several reasons. Firstly, it is a legal requirement that helps protect everyone on the road. Secondly, car accidents can result in significant financial losses, and having insurance coverage can help mitigate these costs. Additionally, car insurance provides peace of mind, knowing that you have financial protection in case of an accident or unforeseen event.

6. How to choose the right Baton Rouge Car Insurance? 🤔

Choosing the right Baton Rouge Car Insurance can be overwhelming, given the numerous options available. Here are a few key factors to consider:

– Coverage: Assess the coverage options provided by different insurers and choose one that meets your needs.

– Cost: Compare quotes from multiple insurers to find the most affordable option without compromising on coverage.

– Reputation: Research the reputation and customer reviews of insurance providers to ensure reliability and good customer service.

– Deductibles: Evaluate the deductibles offered by insurers and choose one that aligns with your budget and risk tolerance.

Advantages and Disadvantages of Baton Rouge Car Insurance

1. Advantage: Comprehensive Coverage

Comprehensive coverage is a valuable aspect of Baton Rouge Car Insurance. It protects your vehicle against non-collision incidents such as theft, vandalism, fire, and natural disasters. With this coverage, you can have peace of mind knowing that your car is protected from a wide range of potential hazards.

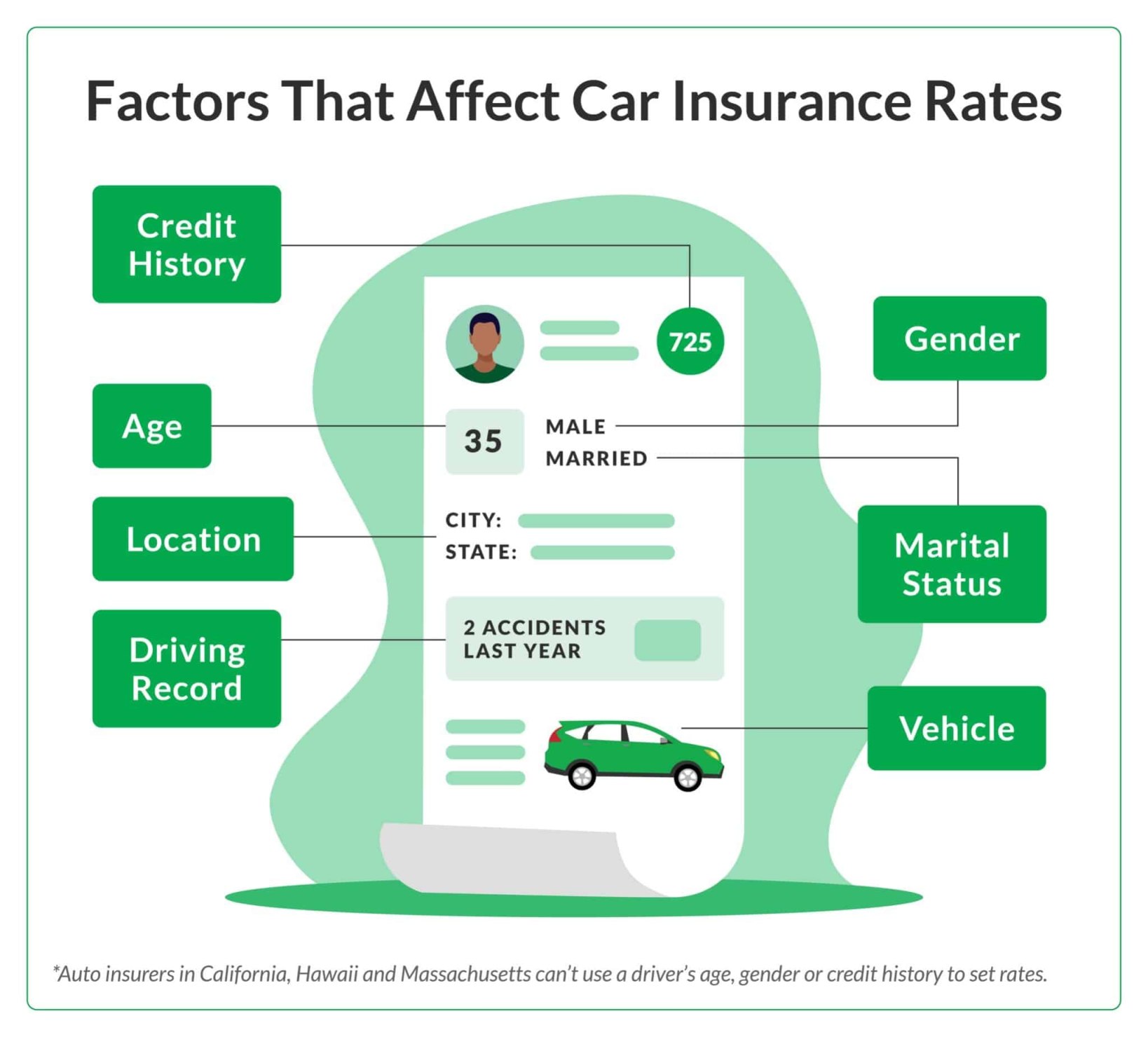

2. Disadvantage: High Premiums

One of the downsides of Baton Rouge Car Insurance is the potential for high premiums. Insurance rates can vary depending on several factors such as your age, driving history, and the type of car you own. It is essential to shop around and compare quotes to find the best rates.

3. Advantage: Legal Compliance

Baton Rouge Car Insurance helps you meet the legal requirement of having car insurance. Driving without insurance can lead to severe penalties, such as fines, license suspension, and even imprisonment. Having car insurance ensures that you are compliant with the law.

4. Disadvantage: Deductibles and Out-of-Pocket Expenses

Most car insurance policies have deductibles, which are the amount you have to pay out of pocket before the insurance coverage kicks in. High deductibles can be burdensome in case of an accident, as you will have to bear a significant portion of the repair costs.

5. Advantage: Financial Protection

Car accidents can result in substantial financial losses, including medical expenses, vehicle repairs, and legal fees. Baton Rouge Car Insurance provides the necessary financial protection to help cover these costs. It prevents you from experiencing severe financial strain in the event of an accident.

Frequently Asked Questions (FAQs)

1. Is car insurance mandatory in Baton Rouge? 🚘

Yes, car insurance is mandatory in Baton Rouge, Louisiana. All drivers must carry a minimum amount of liability insurance as required by the state.

2. What is the minimum car insurance coverage required in Baton Rouge? 📜

As per Louisiana law, the minimum liability coverage limits for car insurance in Baton Rouge are $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $25,000 for property damage.

3. Can I get car insurance with a bad driving record? 📉

Yes, you can still get car insurance with a bad driving record. However, your premiums may be higher due to the increased risk associated with your driving history.

4. Can I choose my auto repair shop after an accident? 🛠ï¸

Yes, you have the right to choose your preferred auto repair shop after an accident. However, if you choose to go to a non-preferred shop, you may be responsible for any additional costs that exceed what your insurance company would typically pay.

5. What should I do if I’m involved in a car accident? 🚧

If you’re involved in a car accident, make sure to prioritize your safety and the safety of others. Contact the police, exchange information with the other party, and notify your insurance company as soon as possible to report the incident.

Conclusion

In conclusion, Baton Rouge Car Insurance is an essential requirement for all drivers in Baton Rouge. It provides financial protection, legal compliance, and peace of mind. By understanding the what, who, when, where, why, and how of Baton Rouge Car Insurance, you can make informed decisions when choosing the right coverage for your needs. Remember to compare quotes, consider the advantages and disadvantages, and ask relevant questions to insurance providers before making a decision. Stay safe on the roads with the right car insurance coverage!

Thank you for reading this comprehensive guide on Baton Rouge Car Insurance. If you have any more questions or need further assistance, feel free to reach out to us. Drive safely, friends!

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered legal or financial advice. Please consult with a professional insurance agent or attorney for specific guidance regarding car insurance in Baton Rouge.

Comments

Post a Comment