What Is The Average Cost Of Medicare Supplement Insurance

Introduction

Dear Readers,

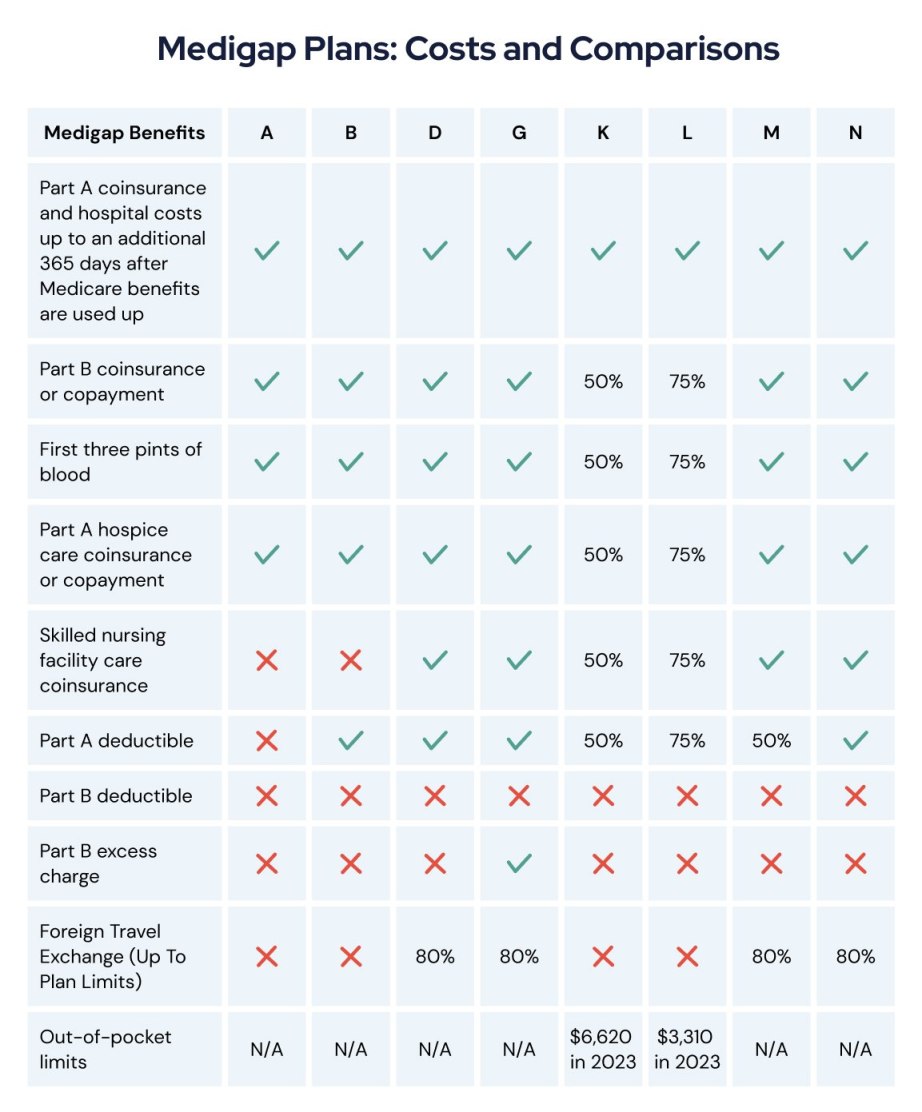

Image Source: retireguide.com

Welcome to our comprehensive guide on understanding the average cost of Medicare Supplement Insurance. In this article, we will delve into all the essential aspects of this topic to provide you with valuable insights. Medicare Supplement Insurance, also known as Medigap, is an optional coverage plan that helps fill the gaps in Original Medicare. It is designed to cover expenses such as co-payments, deductibles, and coinsurance that aren’t covered by Medicare alone. Understanding the average cost of Medicare Supplement Insurance is crucial for individuals planning their healthcare finances. So, let’s dive in and explore the details!

What Is Medicare Supplement Insurance?

🔠Medicare Supplement Insurance, or Medigap, is a type of health insurance policy offered by private companies to cover the out-of-pocket expenses not covered by Original Medicare. It helps pay for costs like copayments, deductibles, and coinsurance that beneficiaries would otherwise have to pay. Medigap policies are regulated by federal and state laws to protect consumers and ensure standardization.

🔠Who can benefit from Medicare Supplement Insurance?

🔠When should one consider purchasing Medicare Supplement Insurance?

🔠Where can individuals purchase Medicare Supplement Insurance?

🔠Why is it important to understand the average cost of Medicare Supplement Insurance?

🔠How can individuals determine the right Medicare Supplement Insurance plan for their needs?

Advantages and Disadvantages of Medicare Supplement Insurance

Advantages:

1. Comprehensive Coverage: Medicare Supplement Insurance plans offer extensive coverage for various medical expenses, giving beneficiaries peace of mind.

2. Freedom to Choose Providers: With Medigap, individuals can choose any healthcare provider who accepts Medicare patients, without the need for referrals or network restrictions.

3. Guaranteed Renewable: As long as premiums are paid, Medicare Supplement Insurance policies are guaranteed renewable, ensuring continuous coverage.

4. Coverage While Traveling: Medigap policies often include coverage for emergency medical care while traveling outside the United States.

5. No Network Restrictions: Unlike some other types of health insurance plans, Medigap policies do not have network restrictions, allowing individuals to access care from any Medicare-approved provider.

Disadvantages:

1. Premium Costs: Medicare Supplement Insurance plans can have higher monthly premiums compared to other health insurance options.

2. Separate Prescription Drug Coverage: Medigap plans do not include prescription drug coverage, so individuals may need to purchase a separate Medicare Part D plan.

3. Limited Coverage Options: Medigap plans offer standardized coverage options, which may not meet the specific needs of every individual.

4. No Coverage for Long-Term Care: Medicare Supplement Insurance does not cover expenses related to long-term care, such as nursing home care.

5. Potential Rate Increases: While Medicare Supplement Insurance policies are guaranteed renewable, insurance companies may increase premiums over time.

Frequently Asked Questions (FAQs)

Q1: Can I apply for Medicare Supplement Insurance if I have pre-existing conditions?

A1: Yes, you can generally apply for Medicare Supplement Insurance regardless of pre-existing conditions during your Medigap Open Enrollment Period.

Q2: Will my Medicare Supplement Insurance plan cover prescription drugs?

A2: No, Medicare Supplement Insurance plans do not include coverage for prescription drugs. You will need to enroll in a separate Medicare Part D plan for prescription drug coverage.

Q3: Can I switch Medicare Supplement Insurance plans?

A3: Yes, you can switch Medicare Supplement Insurance plans at any time. However, you may be subject to medical underwriting and could be denied coverage or charged higher premiums based on your health condition.

Q4: Will Medicare Supplement Insurance cover my Medicare Advantage plan costs?

A4: No, Medicare Supplement Insurance plans only work with Original Medicare. They do not cover costs associated with Medicare Advantage plans.

Q5: Will I still need to pay the Medicare Part B premium if I have a Medicare Supplement Insurance plan?

A5: Yes, you will still need to pay the Medicare Part B premium in addition to your Medicare Supplement Insurance premium.

Conclusion

In conclusion, understanding the average cost of Medicare Supplement Insurance is crucial for individuals planning their healthcare finances. It is important to carefully evaluate the advantages and disadvantages of Medigap plans to determine if they align with your specific needs and budget. By considering factors such as premium costs, coverage options, and potential rate increases, you can make an informed decision. Remember to compare different Medicare Supplement Insurance plans and consult with a licensed insurance agent to find the best coverage for your unique situation. Take charge of your healthcare and ensure financial security with Medicare Supplement Insurance!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or medical advice. It is always recommended to consult with a licensed insurance professional or healthcare provider for personalized guidance regarding your specific situation.

Comments

Post a Comment